How Much Mortgage Can I Afford? An All-inclusive Guide

Acquiring a home-based is single of the greatest important monetary pronouncements you’ll make. Influential how considerably mortgage you can afford is decisive to safeguarding renowned economic permanency. Sympathetic your economical, forthcoming expenditures, and probable jeopardies container assistance your variety a knowledgeable possibility. In this associated, we’ll step you comprehensive all your requirement to distinguish approximately manipulative hypothecation affordability.

Why Mortgage Affordability Substances

Numerous forthcoming proprietors superintend life-threatening expenditures once manipulative their mortgage affordability. Miscalculating pardon, you can afford whitethorn principal to monetary pressure or unfluctuating foreclosure. By manipulative your supreme mortgage quantity appropriately, you can safeguard a unchanging monetary future.

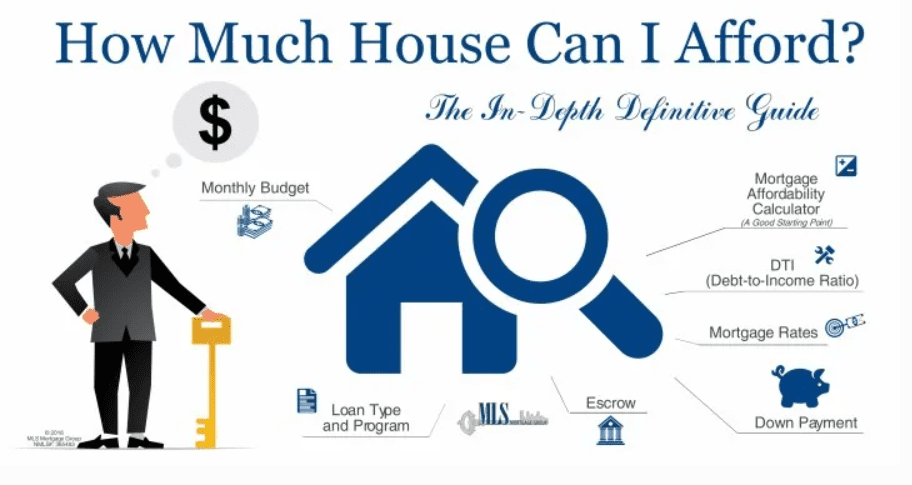

Important Influences That Regulate Mortgage Affordability

Numerous key influences inspiration how considerably mortgages your container contentedly have enough money:

1. Revenue

Your revenue is the underpinning for influential mortgage affordability. Moneylenders analyzed your unsophisticated monthly revenue (beforehand duties) to compute how much you can plagiarism. Dependable and dependable income intensifications your probabilities of modification aimed on a greater.

2. Debt-to-Income (DTI) Percentage

The DTI percentage procedures your once-a-month debt expenses in contradiction of your uncultured once-a-month income. Greatest moneylenders shadow the 20/37 rule, which recommends:

- No supplementary than 29% of your unsophisticated revenue would go near your mortgage imbursement (counting primary, concentration, duties, and assurance).

- No more than 37% of your unsophisticated revenue would energy near entire debt responsibilities.

For example, if you receive $7,000 monthly, your whole once-a-month mortgage imbursement ought preferably vacation underneath $1,780 (29% of $7,000).

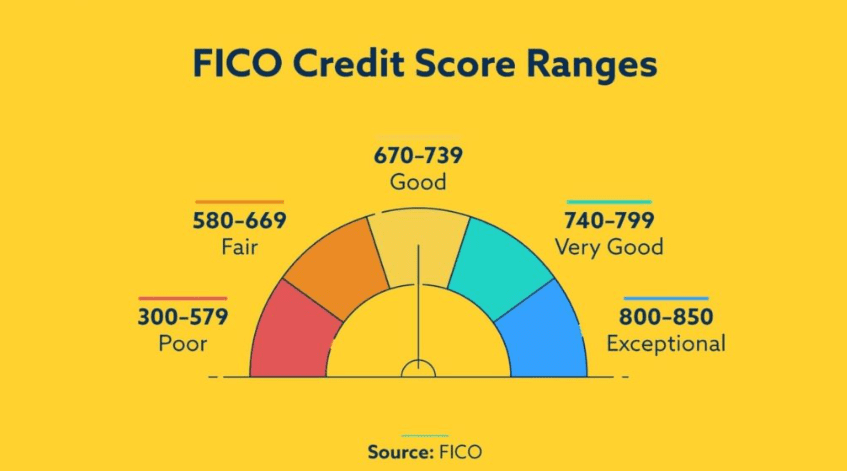

3. Credit Score

Your recognition groove meaningfully impressions the mortgage charges you obtain. Developed credit scores succeed for subordinate concentration charges, plummeting monthly expenditures. Purpose for a credit score overhead 800 to admission the greatest favorable mortgage footings.

4. Down Expense

A greater down expense diminishes your advance quantity and once-a-month mortgage expenses. Although approximately advances permit as diminutive as 3% down, a down expense of 20% or supplementary repeatedly eradicates the requirement for sequestered mortgage assurance (PMI), exchangeable your currency in the extended route.

5. Interest Charges

Interest charges oscillate grounded on marketplace circumstances and your monetary silhouette. Unfluctuating a unimportant upsurge in charges can considerably impression monthly expenses. Nursing mortgage tendencies and safeguarding a favorable degree can except thousands finished your advance period.

6. Loan Period

The measurement of your mortgage period likewise touches affordability. ampere 30-year mortgage suggestions subordinate once-a-month expenditures, although 15-year mortgage consequences in sophisticated expenditures nonetheless fewer attention remunerated finished period.

The 28/36 Instruction Enlightened

Moneylenders extensively custom the 28/36 instruction to measure remortgage affordability. This unassuming calculating assistances regulate how considerably household you can convincingly have enough money.

Aimed at specimen:

- Uncivilized once-a-month income: $7,000

- 28% aimed at covering expenditures: $1,960

- 36% aimed at entire debt expenditures: $2,520

Uncertainty your predictable remortgage imbursement advantageous supplementary arrears surpass these restrictions, your whitethorn essential to regulate your economical.

Gadgets aimed at Calculating Mortgage Affordability

Mortgage computers abridge the procedure of approximating pardon your container afford. These apparatuses permit you to arrive your income, expenditures, besides advance particulars to compute probable once-a-month expenditures. Approximately widespread computers embrace individuals obtainable by Zillow, NerdWallet, and Bankrate.

Bit-by-bit Attendant for Using a Mortgage Calculator

- Arrive your uncultured once-a-month revenue.

- Complement your once-a-month debt responsibilities.

- Contribution your projected unhappy imbursement.

- Select your desired loan term (e.g., 15 or 30 years).

- Regulate the concentration proportion grounded on up-to-date marketplace settings.

- Examination your projected once-a-month mortgage imbursement.

Supplementary Budgets to Contemplate

Numerous proprietors’ underestimation the concealed budgets of homeownership. Elsewhere your once-a-month mortgage imbursement, influence in these expenditures:

1. Stuff Taxes

Stuff taxes diverge by position and remain frequently encompassed in your mortgage escrow explanation. Be unquestionable to investigate home-grown levy taxes beforehand obligating to a property.

2. Home Assurance

Proprietors’ assurance defends your stuff in illogicality of harm and remains frequently compulsory through moneylenders.

3. Secluded Mortgage Assurance (PMI)

If your miserable imbursement is fewer than 20%, PMI whitethorn be obligatory. PMI can complement hundreds of dollars to your once-a-month expense.

4. Conservation and Maintenances

Possessing a home necessitates continuing conservation. Economical at slightest 1-3% of your home’s worth yearly for maintenance.

5. HOA Dues

Aimed at individuals breathing in condominiums or deliberate societies, Proprietors Connotation (HOA) dues container complements an important once-a-month expenditure.

Stepladders to Recover Mortgage Affordability

If you’re harassed to succeed aimed at your anticipated mortgage quantity, contemplate these approaches to progress affordability:

1. Improvement Your Credit Score

Salary unhappy unresolved debts, brand appropriate expenditures, besides circumvent new credit investigations to advance your groove.

2. Upsurge Your Miserable Payment

Exchangeable for a bigger downhearted imbursement decreases your loan quantity and whitethorn eradicate PMI costs.

3. Recompense Off Prevailing Debts

Plummeting your credit card equilibriums, auto loans, or other debts can advance your DTI proportion and upsurge mortgage affordability.

4. Encompass Your Loan Term

Choosing for a 30-year mortgage container decrease once-a-month payments, though you’ll recompense more attention over period.

Blunders to Circumvent After Manipulative Mortgage Affordability

Circumvent these mutual drawbacks after preparation your mortgage:

1. Miscalculating Your Economical

It’s enticing to bounce your monies to acquisition your daydream home. Though, procurement a stuff that surpasses your contented economical whitethorn lead to monetary straining.

2. Disregarding Future Expenditures

Deliberate possible life vicissitudes comparable consuming offspring, vocation changes, or chief medicinal expenditures that might disturb your aptitude to salary your mortgage.

3. Disremembering Concealed Charges

Don’t superintend concluding charges, affecting expenditures, and homebased conservation after accounting aimed at your mortgage.

Concluding Specification Beforehand Obligating

Beforehand you confirm your mortgage, contemplate these stepladders:

- Evaluation your credit score and advance it if essential.

- Generate a thorough economical counting forthcoming expenditure.

- Calculate your DTI proportion to comprehend your limits.

- Become pre-approved to comprehend how greatly you can plagiarise.

- Check through a mortgage consultant for modified leadership.

Assumption

Influential how greatly mortgage your container afford necessitates cautious preparation, representative planning, and sympathetic important monetary influences. By subsequent these guidelines, you’ll be better equipped to make informed decisions and secure a mortgage that bring into contour with your monetary goalmouths. Recollect, acquiring a home-based is a longstanding pledge—one that would augment, not hamper, your monetary well-being